43+ paying off mortgage with 401k after 59 1 2

If youre paying 4 on your mortgage and you have nonretirement cash accounts earning less than 1 retire the mortgage. Its also possible to cash out before although doing so would trigger a 10.

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Paying off your mortgage by draining all your liquid savings may actually make you less financially secure.

. Web But if you withdraw money from your 401 k prior to age 59½ not only will you have to pay taxes youll also be hit with a 10 percent penalty. Web After you reach age 59 12 you dont face the 10 percent early withdrawal penalty and you may face a lower income tax rate during retirement than you did during your career. It has no effect on the taxation of the.

Web The 401 k Withdrawal Rules for People Between 55 and 59 ½ Most of the time anyone who withdraws from their 401 k before they reach 59 ½ will have to pay a. Compare More Than Just Rates. Withdrawing money when you retire.

Web There is a 10 percent penalty if you take out the money too soon before you reach age 59½. Web 1 Another study revealed that 44 of 60- to 70-year-old homeowners are carrying mortgage into retirement and 32 expect it will take them more than eight years to pay it off. Typically those who havent reached 59½ must pay a 10 percent penalty money.

Web You are free to empty your 401 k as soon as you reach age 59½or 55 in some cases. Web When you turned 59 12 it meant that withdrawals from 401ks and IRAs do not incur a 10 penalty for early withdrawal. When you deplete your savings.

Find A Lender That Offers Great Service. If you dont need. Web This calculation seems straightforward.

Web How to take money out of your 401k There are many different ways to take money out of a 401k including. Web If that distribution moves you from the 12 to 22 marginal bracket or from the 24 to 32 bracket then youre paying Uncle Sam a tax premium of 8 to 10 just. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Web As per the rule participant may begin to withdraw money from their 401 K once he or she reaches the age of 59 12 without paying 10 early withdrawal penalty. Web These penalties apply to 401 k withdrawals rather than 401 k loans. Web Some 403b plans include a loan option which allows you to access your retirement funds for a big purchase and then pay yourself back with interest over time.

Ad Enter Your Mortgage Details Calculate Your Monthly Payment and Contact Lenders. Ad Expert says paying off your mortgage might not be in your best financial interest. Advertisement Depending on your income contributions to a.

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Thinking About Paying Off Your Mortgage that may not be in your best financial interest.

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

Tax Loopholes For Paying Off House With 401 K

Should I Pay Off My Mortgage With My 401 K Lighthouse Financial Enterprises Inc

I Want To Pay Off My Mortgage Should I Take A 401 K Loan Nj Com

Q A Should I Pay Off Mortgage With My 401 K

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

Should I Pay Off My Mortgage With Money From My 401 K The Washington Post

Eclipse April 27 By Mid America Publishing Corporation Issuu

Oregon Financial Services Businesses For Sale Bizbuysell

Think Twice Before Paying Off Your Mortgage Early Knowledge At Wharton

How To Pay Off A 401k Loan Early The Budget Diet

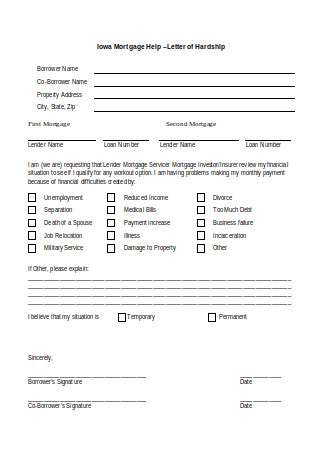

40 Sample Hardship Letters In Pdf Ms Word

40 Sample Hardship Letters In Pdf Ms Word

08 24 12 Ocean City Today By Oc Today Issuu

:max_bytes(150000):strip_icc()/picture-53894-1440689455-5bfc2a8846e0fb00260af532.jpg)

Using Your 401 K To Pay Off A Mortgage

Should You Use Your 401 K For A House Down Payment Credible

Should You Pay Your Mortgage Off Early Calculator Included Young Dumb And Not Broke